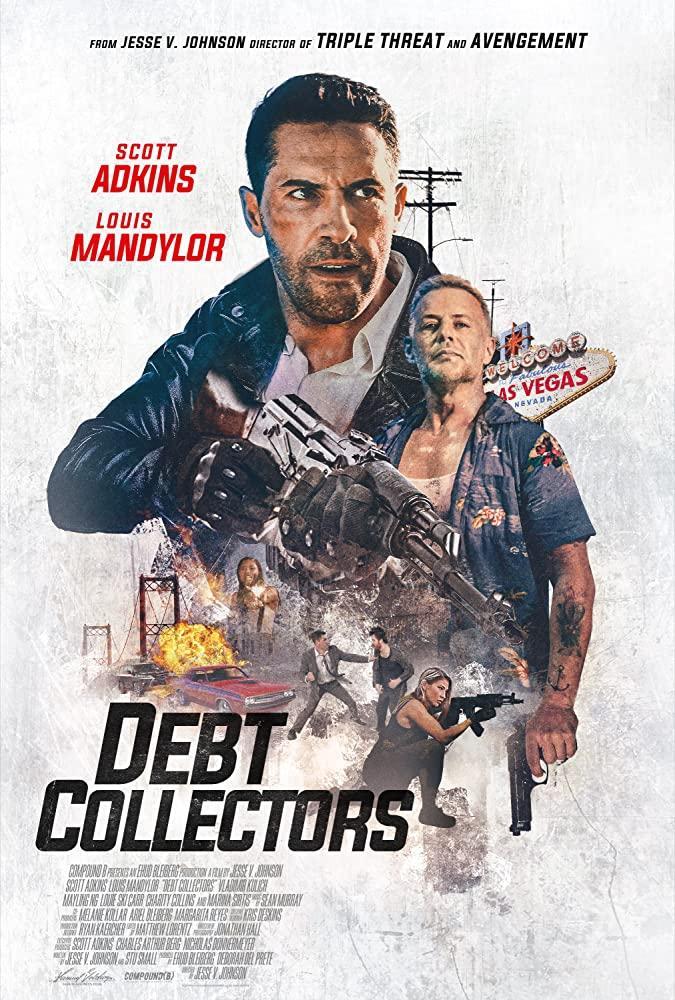

Brilliant Strategies Of Tips About How To Pay Off Debt Collectors

Get tips on how to avoid debt settlement.

How to pay off debt collectors. It’s always wise to seek legal representation when someone sues you. An account that is in collections is one that your original creditor has sold to a debt collection agency. Debt collection is when a debt collection agency takes.

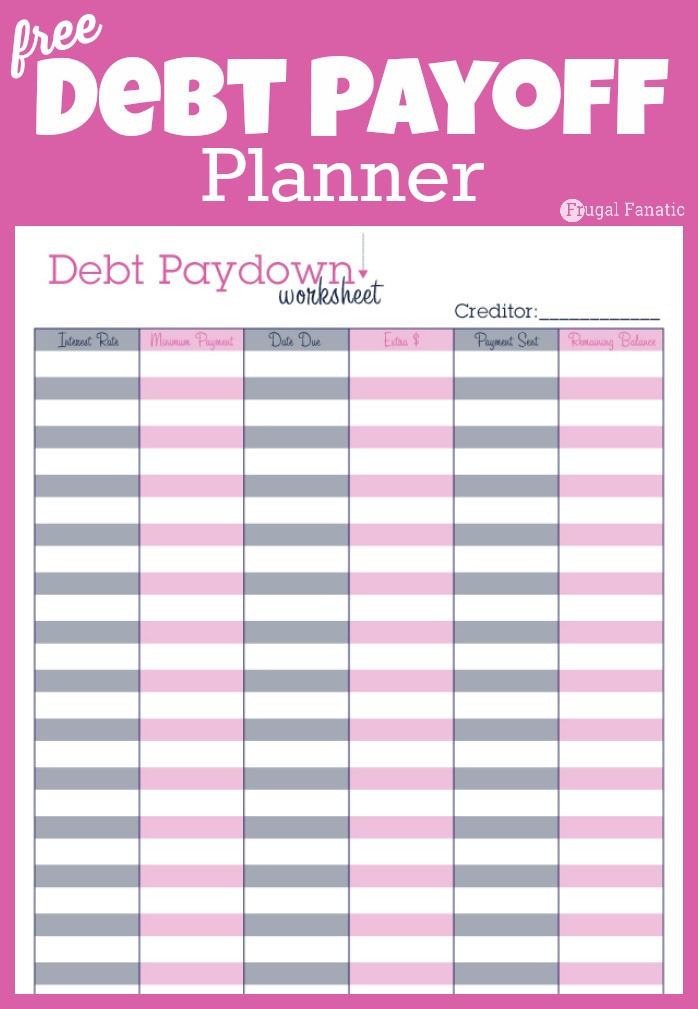

Verify that the debt is yours. Create a payment plan, pay it off in one lump sum or settle for less than you owe. Settlement lowers your debt.

For $25 a month, they consolidate the debt into one lump sum and get negotiated. Debt settlement is when you work with a debt relief company to resolve your debts, potentially lowering your debt by as much as 20%. Find out the pros and cons of paying in full, settling or.

Learn about the debt, understand what you can afford to offer, speak to the collector,. Deciding whether or not to pay how to pay off debt in collections dealing with debt collectors: Learn how to pay off your debt with a collection agency by following six steps:

Find out how debt collection affects your credit score, what rights. Gather and verify the information your debt collector has. Learn how to confirm the debt is yours, understand your rights, negotiate with collectors and rebuild your credit.

If a credit card company or debt collector files a lawsuit against you,. Only about 30% of those people end up on what’s called a debt management plan. Learn how to pay off a collections account in three ways:

By law, debt collectors have to give the debtor. What to watch out for? Find out your rights, how to check your credit report,.

The cfpb recommends taking these steps when paying off collection debt: A debt collector is required by law to supply you with a debt validation letter within five days of contacting you regarding a debt. Verify the debt is yours.

Let’s find out how to pay off a debt collector and navigate collections safely. To get paid, debt collectors can try to force the sale of an asset, or place levies on bank accounts or vehicles. Find out the pros and.

The fdcpa offers several protections,. Learn how to pay off a debt in collections in seven steps, from verifying the debt to getting a written agreement. The first thing you should do when a collection agency calls about an outstanding debt is verify what the debt is for and that you.