Unique Tips About How To Learn Your Credit Score

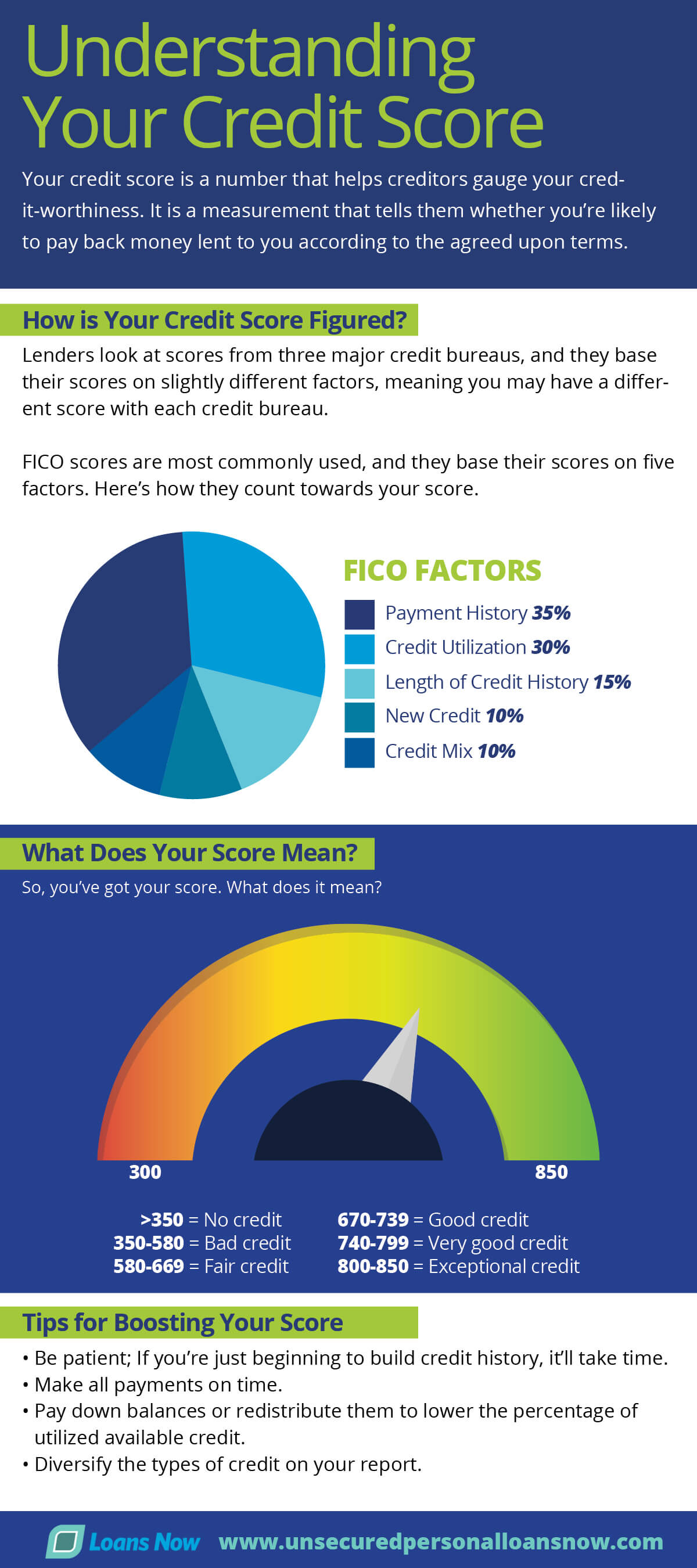

If you have a credit card with a $10,000 limit, for example, and are carrying a $6,500 balance, your credit utilization is 65%.

How to learn your credit score. There are a few main ways to get your credit scores. It’s also the largest single component in. Learn how the changes to medical debt reporting on credit reports affects your credit scores, and actions you can take to help prevent debt from medical bills.

Understanding your score is the first step in creating a strong credit profile. Find a credit score service. So if you want to fix your credit, you should focus on ironing out your monthly payments.

Recently, a new lendingtree study found that raising credit score from fair (580 to 669) to very good (740 to 799) can also help you earn an extra $22,263 over a lifetime. Here are some strategies that could help: You can check your credit score anytime you like.

Check your credit or loan statements. To learn more, view how your credit score is calculated. Here's how to build credit fast:

As proposed right now, the new child tax credit would continue to be partially refundable (so, for a part of the credit you could get a refund even if you didn't owe any tax) and the new rules. Always pay your bills on time. There are four main ways to get your credit score:

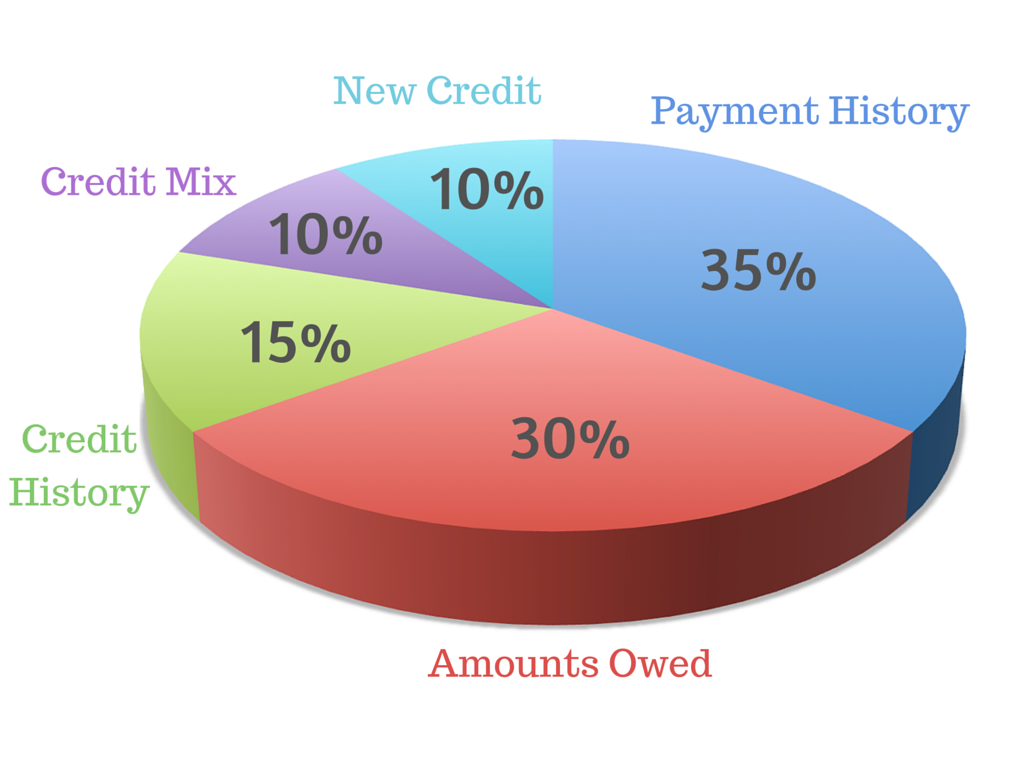

This clip has been taken from the martin lewis money show live on tuesday 30 january 2024. Let’s unpack what each of the five contributing factors means, and how they affect your credit score calculation. The score could be listed on your monthly statement or can be found by logging in to your account online.

Pay off existing balances. How many types of credit in use: Your credit utilization is the percentage of your credit limit that you’re taking up with an existing balance.

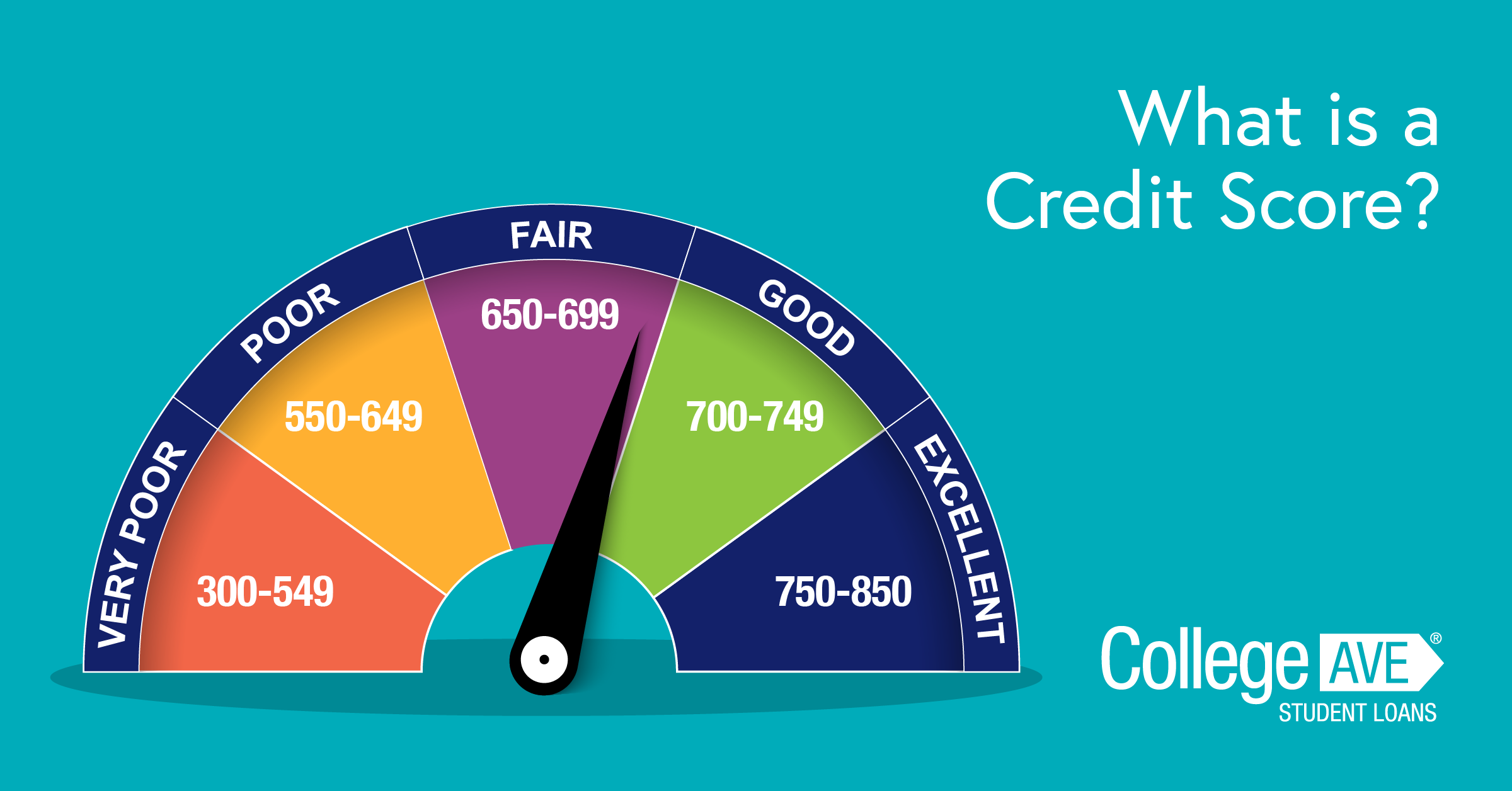

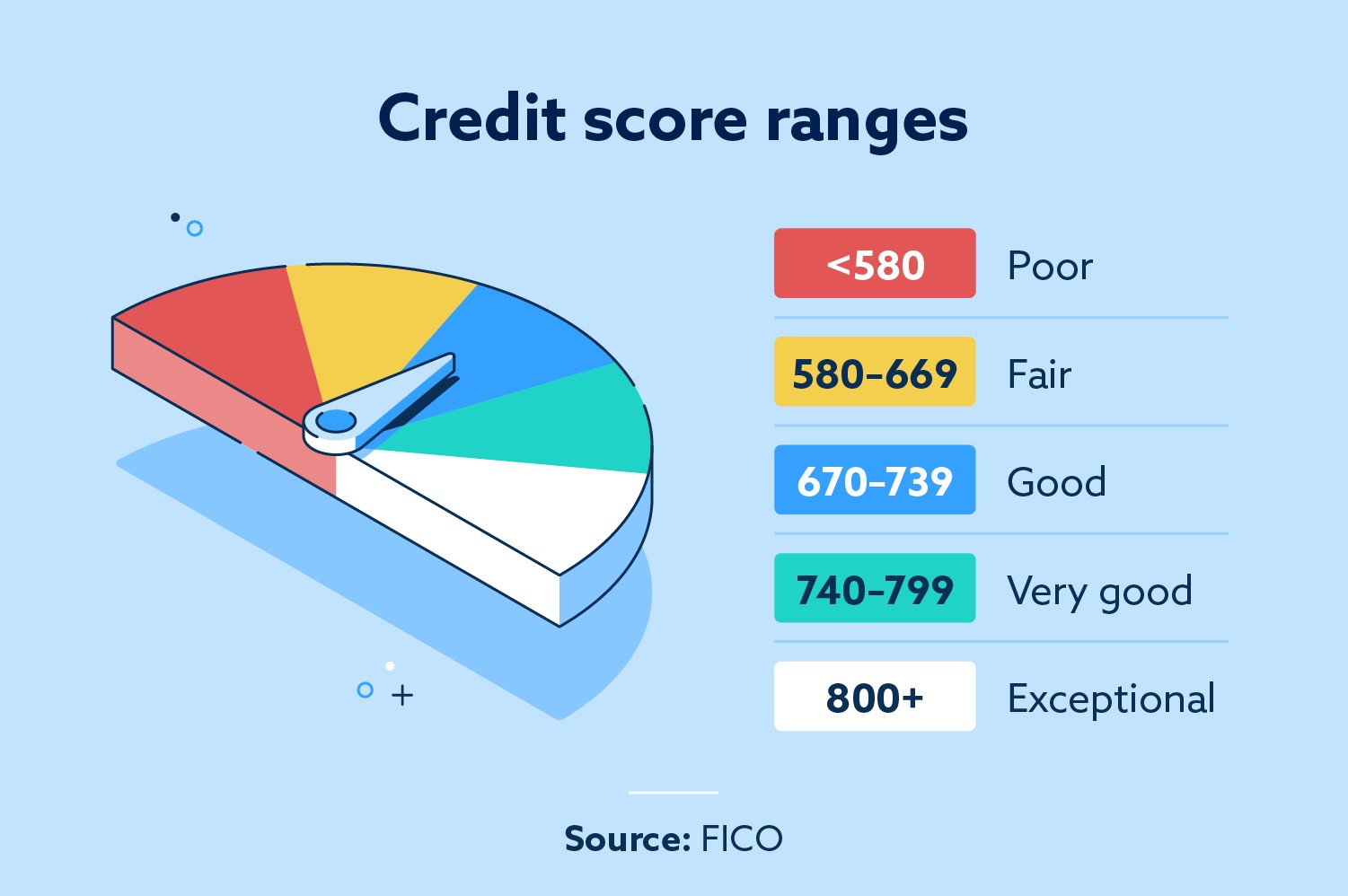

How often should you check your free credit scores? What your credit score means your credit score represents the likelihood that you'll repay a loan based on your history with credit accounts. Get tips about how to grow your score from nerdwallet's experts.

Payment history, amount owed, length of credit history, new credit, and credit mix. Your credit score, which commonly refers to your fico score, is calculated based on five factors: Talk to a credit or housing counselor.

Additionally, it even make you money. Sign up for equifax complete tm premier today! 3 ways to check your credit score 1.