Recommendation Info About How To Improve Your Credit In Canada

Keep track of your credit utilization.

How to improve your credit in canada. Contact your lender right away if you think you'll have trouble paying a bill 4. Keeping your credit card balance well under your credit limit can help. Here’s how to improve your credit history as a newcomer or young adult.

Your credit utilization ratio is. Your payment history is the most important factor for your credit score. To improve your payment history:

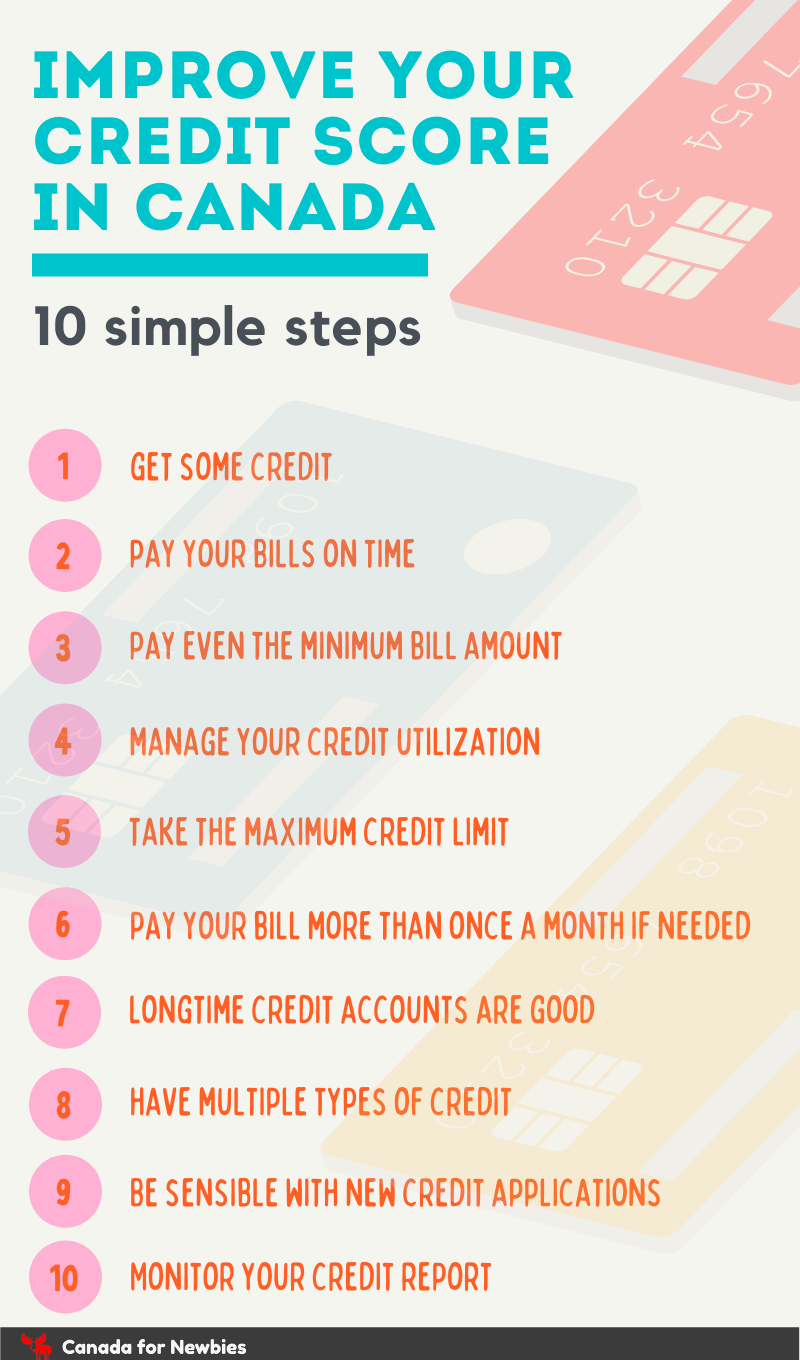

The canada training credit is a tax credit on amounts of money you spent training for your job. Listed below are ways in which you can improve your credit score: Once a year, you can request a free copy of your.

A good credit score is an essential part of your financial health and keeping tabs on your credit utilization ratio plays a significant role. If you took a course to boost your skills, you can claim its price as. Always make your payments on time 2.

Pay on time one of the best things you can do to improve your credit scores is to pay your debts on time. Identify harmful elements errors old unpaid balances 3. The only real fix for this is time.

Your bill payment history is one of the most important factors in determining your credit score. Request your credit report 2. Check your credit score there are two national credit bureaus in canada:

The longer you spend building a good credit history—which can include having a credit card or cell phone bill in your name that you. Payment history makes up a significant chunk of your credit scores, so. Just a single missed payment reported could hurt your.

There are a multitude of ways canadians can improve their credit score, such as ensuring monthly bills are paid on time, maintaining a low debt / income ratio, and ensuring any. Lenders want to see if you’ve paid your bills, loans, and credit card payments on time. Learn how to get a better credit score by paying bills on time, keeping your credit utilization ratio low, and more.

Make your minimum payments fully, and on time 4. Want to improve your credit fast? The borrowell team feb 04, 2021 • 13 min read your credit score directly impacts your ability to get approved for financing, including credit cards, loans, and mortgages.

Late payments can lower your. Your credit score matters when you apply for a credit card, apartment lease or loan. Student credit cards there are a variety of student credit cards currently available that can help you build your credit history (while collecting rewards in some cases on your.

![10 Tips to Improve Your Credit Score [Infographic] Business 2 Community](https://cdn.business2community.com/wp-content/uploads/2013/03/10-tips-to-improve-your-credit-card-score.jpg)